As the dust starts to settle following the Chancellor's Autumn Statement last week we have outlined some of the key announcements that may be of relevance to you, your business and those close to you, including significant changes to Employer National Insurance costs, Capital Gains Tax and Inheritance Tax.

Income Tax

No changes were announced to current income tax rates or thresholds, but current thresholds are remaining frozen until April 2028 as previously announced. From April 2028, thresholds will ‘unfreeze’ and increase in line with inflation.

National Insurance Contributions

Employers’ national insurance (including class 1A on some benefits in kind) will increase by 1.2% to 15% from 6 April 2025.

The Class 1 NIC secondary threshold (at which the 15% charge starts) will reduce from £9,100 to £5,000 per annum increasing the Er's NI liability per employee by £615 p.a. This will take effect from 6 April 2025 until 5 April 2028 and will then increase in line with CPI.

The employment allowance will increase to £10,500 (up from £5,000) from April 2025 and the £100,000 (previous tax year NICs liability) eligibility restriction will be removed making the allowance widely available.

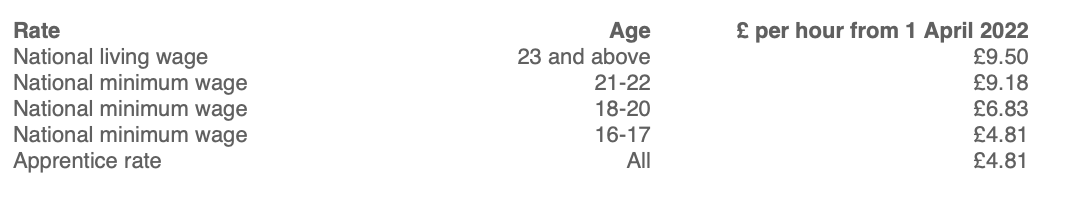

National living and minimum wages

The National Living Wage for employees aged 21 and over will increase to £12.21 per hour from April 2025 (currently £11.44 per hour) making a full-time employee's salary £23,809.50 (based on 37.5 hours p.w on NLW). The National Minimum Wage for 18-20 year olds will rise to £10.00 per hour.

Capital Gains Tax

CGT rates – the main rates of CGT have been increased immediately to 18% and 24% (up from 10% and 20%) for disposals on or after 30 October 2024. The residential property rates remain unchanged at 18% and 24%.

For both business asset disposal relief (BADR – formerly Entrepreneurs Relief) and investors’ relief (IR), the 10% rate remains for the rest of this tax year but will increase to 14% from 6 April 2025 and then to 18% from 6 April 2026.

For assets qualifying for BADR, the lifetime limit of £1,000,000 of gains has not changed. BADR applies to the disposal of certain business assets, including the sale of a business or the sale of a qualifying shareholding (5% or qualifying enterprise management incentive shares) in a trading company/holding company of a trading group, in which you are an officer or employee.

However, for assets qualifying for IR, the lifetime limit of £10,000,000 has been reduced to £1,000,000 from 30 October. This applies to qualifying investor gains on newly issued ordinary shares of an unlisted trading company bought by individuals from 17 March 2016 and held for at least three years starting from 6 April 2016.

Non-domiciled individuals

The remittance basis of taxation for non-UK domiciled individuals will be abolished, with the concept of domicile being replaced with a residence based regime from 6 April 2025.

IHT

Inheritance tax threshold

The inheritance tax threshold provides a tax-free (NRB) allowance of £325,000 - the Chancellor extended the freeze of the threshold from April 2028 to April 2030. Together with the residential nil rate band of up to £175,000 this provides a total tax-free allowance up to £500,000, which combines to £1m for spouses and civil partners, providing the family home passes to direct descendants.

IHT - business relief and agricultural relief reforms

From 6 April 2026, the first £1 million of combined agricultural and business property (including qualifying shares held in family or personal companies) will continue to receive 100% relief, with 50% relief on amounts over £1 million.

Relief for other shares that are not listed on a recognised stock exchange, which includes AIM shares, will reduce to 50%. The £1m allowance does not apply to these shares.

Assets that receive 50% relief are subject to an effective IHT rate of 20%, as opposed to the main rate of 40%, where no relief is available.

The £1m will effectively be a ‘lifetime allowance’, covering the estate on death, failed gifts in the 7 years before death and lifetime transfers into trust. Any unused allowance will not be transferable between spouses.

Trusts will receive a combined £1million allowance. However, where a settlor has settled multiple trusts before 30 October 2024, each of those trusts will have its own £1million allowance.

IHT – unused pension funds and death benefits

From 6 April 2027, the government will bring in unused pension funds (including death benefits payable from a pension) into a person's estate for IHT purposes.

Business Taxes

Corporate Tax Roadmap – alongside the Budget, the government has published a Corporate Tax Roadmap with an emphasis on providing certainty for business, covering commitments to cap the main rate of CT at 25% and retain the current small profits rate (19% on profits up to £50K) and marginal relief structure, maintain full expensing, the £1m annual investment allowance and the ‘generosity of R&D reliefs’.

Capital allowances – 100% first-year allowances for zero-emission cars and electric vehicle charge points will be extended until April 2026.

Double Cab Pick Ups

From 1 April 2025 for Corporation Tax and 6 April 2025 for income tax, double cab pickups (with a payload of one tonne or more) will be classified as cars for capital allowances and benefit in kind purposes.

If you have purchased, leased or ordered a DCPU for an employee before 6 April 2025 you will still be able to use the previous treatment until the earlier of disposal, lease expiry or 5 April 2029, under some transitional rules.

Stamp Duty Land Tax

The existing higher rates of Stamp Duty on the purchase of an additional residential property in England or Northern Ireland by an individual will increase from 3% to 5% for transactions with an effective date (normally completion) on or after 31 October 2024. This will also apply to the purchase of a residential property by a company that is not liable to the single rate of SDLT.

The single rate of SDLT that applies to the purchase of a residential property for more than £500,000 by a company in England or Northern Ireland and which is not intended to be used for certain commercial purposes will increase from 15% to 17%.

If contracts were exchanged before 31 October 2024 but are completed on or after that date, transitional rules may apply.

Late Payment Charges

Late payment interest is currently set at base rate plus 2.5%

From 6 April 2025, the interest rate on unpaid tax liabilities charged by HMRC will increase by 1.5 percentage points to 4% above the base rate.

Company Car Tax

It has already been announced that from April 2025 all company car percentages will be increased by 1% each.

It was announced in the budget that from April 2028 the increase will be 2% per year meaning that the benefit in kind for a zero emissions car will be 9% of the list price by 2029/2030 tax year.

The percentages for all cars with emissions of 1 to 50g of CO2 per kilometre, including hybrid vehicles, will rise to 18% in tax year 2028/29 and 19% in tax year 2029/30

This contrasts with the percentages for all other vehicle bands, which will increase by 1% per year in tax years 2028/29 and 2029/30, to a maximum of 38% for 2028/29 and 39% for 2029/30. This will mean that the cost of the benefit of an EV remains substantially lower for the company car driver, but significantly greater than the recent regime.

VAT on private school fees

It was confirmed that the VAT exemption will be removed from 1 January 2025 on private school fees.

Support and guidance:

We hope that the above summary provides you with a view of some of the latest developments and key areas from the budget that may affect you and your families now and into the future – as always, it is not intended to be a comprehensive list of all of the changes, or a substitute for comprehensive tailored advice and so if you have any queries or concerns, please call the office to arrange a meeting to discuss your specific circumstances and plans.

Barnett & Turner Accountants Ltd

Chartered Accountants

Cromwell House

68 West Gate

Mansfield

NG18 1RR

Nottinghamshire

Tel: 01623 659659

Fax: 01623 420844