Making Tax Digital (MTD) for Income Tax

It has been confirmed that Making Tax Digital (MTD) for income tax will be phased in for self-employed individuals and landlords from April 2026.

What is MTD for Income Tax?

MTD is a mandatory requirement being introduced for eligible individuals (self-employed and landlords) to keep digital records and report their income and expenses to HMRC quarterly, instead of filing just a single Self-Assessment tax return each year.

From April 2026, if your gross turnover, rents or a combination of the two are greater than £50,000 then your income and expenses will need to be reported digitally to HMRC every quarter with an annual reconciliation also being completed (which we expect to be similar to the annual tax return).

From April 2027, the threshold will drop to £30,000 and it was confirmed in yesterday's Spring Statement that MTD for income tax will be made mandatory for the self-employed and landlords with gross income of more than £20,000 from April 2028.

Digital records

MTD for income tax will require self-employed businesses and landlords with qualifying income to keep digital records and file quarterly updates through an HMRC compatible software. HMRC have said that they will not be producing their own software and so individuals who will be affected by the new legislation need to choose a suitable commercial software package or use tailored spreadsheets and bridging software.

If you are not already using a software to maintain digital records or have any questions and would like some help, please get in touch with the office to discuss your particular circumstances, solutions, pricing and the support available well in advance. We have already partnered with providers such as Xero and Quickbooks (QBO) and have bridging software solutions to help manage the ongoing MTD transition, which started with VAT submissions several years ago.

What happens next?

From April 2025, HMRC will be writing to individuals whose 2023 / 2024 Self-Assessment tax returns reported gross income from self-employment and rental sources that was close to (or over) £50,000. Receipt of this letter will indicate that you are expected to comply with the new Making Tax Digital for Income Tax rules in the near future - Don’t panic but please speak with us asap if you receive an HMRC letter regarding MTD or expect your circumstances to meet the criteria described above, whether you receive a letter of not over the coming months!

Digital Tax Compliance Continues to Evolve

With most compulsory VAT registered businesses reporting under Making Tax Digital (MTD) for a few years now, HMRC are looking towards the next tranche of MTD compliance.

The following update may already be in hand or may not affect you directly but feel free to forward on to anyone that you think may benefit from the summary:-

Making Tax Digital for VAT – what’s next?

The Government is extending the requirement to operate (MTD) beyond compulsory VAT registered businesses to include voluntarily VAT registered businesses. For VAT periods starting on or after 1stApril 2022 voluntary VAT registered businesses will also be required to keep digital records and submit VAT returns through a compatible software. Manual returns will no longer be submitted through HMRC’s website. Affected businesses may have already received a letter from HMRC about these changes.

If you or anyone you know would like to discuss this with one of the team including the tailored solutions available, please feel free to call the office and speak to the team.

Making Tax Digital for Income Tax

From 6th April 2024, MTD will also apply to the self employed and landlords with aggregate turnover and / or gross rental income of greater than £10,000.

Affected taxpayers will be required to submit to HMRC quarterly returns on qualifying income and expenses via their personal digital tax account. For now this does not affect taxpayers who are taxed entirely via PAYE or trade only via a limited company. MTD for corporation tax is expected to be announced after MTD for income tax has been successfully rolled out.

Please note that if you have turnover from your self employment of lower than £10,000 and gross rental income of less than £10,000 but in aggregate they are over £10k, both will need to be reported quarterly under MTD as the gross aggregate is key.

We are currently awaiting further information from HMRC regarding the specific rules on MTD for income tax but in the meantime are already working with various software solutions to help meet your needs.

We will keep you posted with further updates as we receive them but please speak with us if you have any queries in the meantime.

Autumn Budget Update 2021

AUTUMN BUDGET UPDATE 2021

Now that the dust has settled and we have been able to review more of the details, here are some of the headline points to forward from the budget at the end of October...

Income Tax Rates and allowances for 2022/23

From 6 April 2022 to 5 April 2026 the personal allowance will increase to £12,570 and the higher rate threshold at £50,270.

National insurance Class 4 limits

The National Insurance rates will rise by 1.25% from 6 April 2022, however from April 2023 the rates will revert to their previous levels and a new 1.25% Health and Social Care Levy will apply to employers, employees and the self employed (including those above State pension age).

The table below shows the changes for the next 2 years:

Capital Gains Tax

The capital gains tax annual exempt amount will remain at £12,300 for the tax year ended 5 April 2023.

Capital Gains Tax payment window

From 27 October 2021 the deadline for UK residents to report and pay CGT after selling a UK residential property will increase from 30 days to 60 days.

For non UK residents disposing of property in the UK the deadline will also increase from 30 days to 60 days.

Inheritance Tax

Inheritance tax thresholds and rates are unchanged. The nil rate band will remain at £325,000 for the 2022/2023 tax year.

The residence nil rate band will also remain at £175,000

National Living Wage

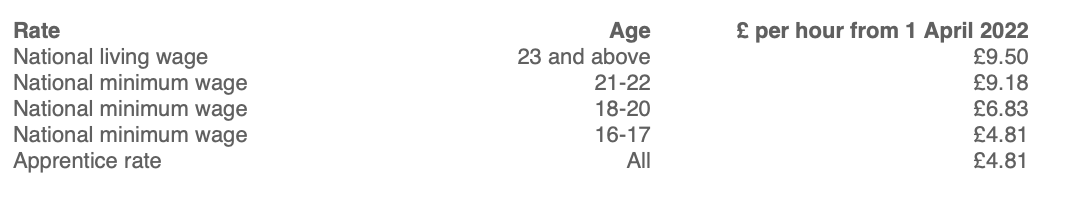

The rates for National Living Wage (for those aged 23 and over) and the National Minimum Wage (for those of at least school leaving age) from 1 April 2022 are shown below.

Dividend Tax

The dividend allowance will remain at £2,000. The rate of tax on divdends will rise by 1.25% from April 2022 as shown in the table below.

Corporation Tax

The main rate of corporation tax will remain at 19% for the year commencing 1 April 2022 and will rise to 25% from April 2023 for business with profits of £250,000 and over.

The rate for businesses with profits of £50,000 or less will remain at 19% however there will be a marginal rate (at 26.5%) for profits between £50,000 and £250,000.

Super-deduction for investments in plant and machinery

A reminder that companies liable to corporation tax will temporarily be entited to increase allowances for expenditure on new plant and machinery.

For qualifying expenditure incurred from 1 April 2021 up to and including 31 March 2023 companies will be able to claim a super deduction providing a first year allowance of 130% on most new plant and machinery additions that ordinarily qualify for 18% main rate writing down allowances.

Also a first year allowance of 50% is available on most new plant and machinery investments that ordinarily qualify for 6% special rate writing down allowances.

The relief will not apply to contracts entered into prior to Budget day on 3 March 2021.

Annual Investment Allowance (AIA)

The temporary £1 million level of AIA has been extended to 31 March 2023.

Recovery Loan Scheme

The recovery loan scheme will be extended to 30 June 2022 for small and medium sized business but the government guarantee will be reduced from 80% to 70%.

VAT

Registration and deregistration thresholds

The current VAT thresholds for registration and deregistration (£85,000 and £83,000 respectively) will be maintained until 31 March 2024.

Company Car and Van benefits

The company car fuel multiplier will increase to £25,300 from April 2022.

The company van benefit will increase to £3,600 from April 2022.

The van fuel benefit will increase to £688 from April 2022.

The company car benefit for electric cars will increase to 2% of the list price from 6 April 2022 (currently 1%).

The table below shows the rates for all company cars from 6 April 2022:

The help on hand from your accountant

Your accountant can help you in a number of different ways, argues Jono Wilson of accountancy firm Barnett & Turner. Here, he lists five of the most important contributions they can make.

What exactly is your accountant there for? Providing a sounding board for your business plans? Offering you peace of mind? I think it’s both those things and a number of others besides. Here are just some of the reasons you need that trusted professional adviser on call:

1. We give you time back

Time is a precious commodity for anyone running a business. Not to mention important for quality of life outside work too. By taking care of compliance issues, or taking responsibility for day-to-day processing, your accountant can free up valuable space for you to focus on things that really matter. We can also claw back some extra time by looking at your current ways of working and giving you tips on how to be more efficient.

2. We remove those nagging worries

Have you filed your return by a particular date? Did you complete that HMRC form correctly? Your own strengths might lie elsewhere, in your creative flair or specialist skills. Leaving the day-to-day accountancy and administrative burden to people you know are experts in that field is very reassuring.

3. We can provide useful insights

Very often, as a business owner, you’re going on a one-off journey. That means you’re dealing with everything for the first time. That first attempt at fundraising for instance, or a tricky commercial negotiation. Or perhaps you’re considering your plans for an ultimate exit from the business. We have seen these scenarios before and have helped other clients through them, which means we can offer practical advice and an impartial perspective.

4. We can help make you more money

When we work on your accounts or conduct an audit, we gain an understanding of your business. This tells us what you’re doing well and what’s working less efficiently. If there’s an overspend, for example, we’ll be able to spot it for you. All in all, we play an important part in getting your finances into shape.

5. We can become your trusted advisers and more

If your accountant is delivering on all of these points, they will soon become established as your trusted adviser, a position that will strengthen with time. And if you can share a drink with that adviser once in a while, it certainly doesn’t do any harm!

If you would like to discuss anything related to this article please do not hesitate to call Barnett & Turner on 01623 659659 or email Jonathan at jwilson@barnettandturner.co.uk

Your dream build needn’t be a financial nightmare

There are probably relatively few of us brave enough to construct a home from scratch. After all, it takes a real sense of vision, commitment and dedication. Perhaps a slightly larger group of us might consider converting an existing building. In either scenario, however, costs are always an issue and can easily spiral.

It’s worth knowing that you may well be able to recover the VAT you’ve been charged on certain building materials and services. HMRC’s DIY Builders and Convertors VAT Refund Schemecovers new builds and non-residential conversions, where the property has been empty for a decade or more. Even if you intend to use the home for family holidays, it may be included in the scheme under certain conditions.

Things to remember

· You must obviously get planning permission for the work before commencing.

· Your contractors must apply the correct VAT rate to their services, as incorrectly charged VAT will be excluded from your refund claim. (Many services supplied in connection to a new build or conversion will qualify for 0% or 5% VAT.)

· You’ll be recovering VAT charged on work done to the fabric of the property, certain works within the grounds and on particular building materials. These might include fitted kitchen furniture, wooden flooring and solid fuel cookers.

· You won’t be able to claim for professional fees, the hiring of machinery or fitted furniture, such as carpets and some electrical appliances.

How to apply

You must submit applications to HMRC no later than three months after the completion date. There’s a fair bit of paperwork involved, as you need to answer questions and include schedules for each VAT rate charged.

You must also supply a range of original documents. As well as the original VAT invoices, you may need to send evidence the property had been empty for ten years prior to your conversion work. HMRC will also expect a copy of the planning permission, a full set of building plans and the completion certificate.

It’s advisable to get the support of your accountant from start to finish to ensure that the claim is accurate and complete.

If you would like to discuss anything related to this article please do not hesitate to call Barnett & Turner on 01623 659659 or email Jonathan at jwilson@barnettandturner.co.uk

Management accounts – some frequently asked questions

Why do I need management accounts?

If you’re planning on expanding your business, making capital expenditure or cutting back on costs, management accounts become very important to give you insights for your decision-making.

Can’t I get this information from my annual accounts?

By the time you come to review annual accounts, you might find that costs have spiralled or that issues have arisen which it’s now too late to resolve. By producing regular management accounts, you can get a real-time snapshot of how your business is performing.

How often should they be produced?

Management accounts are usually prepared monthly or quarterly, which can really help with capital expenditure planning, profit extraction and taking advantage of capital allowances.

How can it work in practice?

Imagine a fast-growing and dynamic business which is struggling to keep control of costs and profit margins. Current processes are inadequate for the expanding company and the amount of profit made on each contract is unclear. With the help of Xero cloud accounting and management accounts, this business could identify cost-saving measures, including the renegotiation of hire contracts and insurance. They could also quickly spot non-profitable business, allowing them to pick and choose more lucrative contracts.

If you would like to discuss anything related to this article please do not hesitate to call Barnett & Turner on 01623 659659 or email Jonathan at jwilson@barnettandturner.co.uk

A straightforward guide to effective team management

Outsourcing Manager at accountancy firm Barnett & Turner, Natalie Goodall, has been learning quickly some of the best ways of achieving success and motivating a team. Here, she shares ten of her top tips.

1. SHOW THAT YOU’RE HUMAN

It’s important to be a real person, as it creates a more comfortable environment. People feel less intimidated when you show your human side.

2. DELEGATE EFFECTIVELY

You can’t do everything yourself, but when you delegate, it’s essential to take into account people’s background, skills and knowledge. No one wants to feel out of the depth, but equally, you can’t pigeonhole team members either. They need to have the chance to learn something new.

3. GIVE FEEDBACK

While you’ll probably hold formal appraisals at regular intervals, informal feedback is vital too – both positive and negative. Even if people have performed tasks correctly, it’s always important to offer constructive suggestions on the way in which they could have been done better. Equally, it’s essential to acknowledge success.

4. COMMUNICATE

People aren’t mind readers. If you don’t keep them informed, how can you expect them to do what they need to do? In small businesses, you can often impart information face to face, but in larger companies, you’ll need a chain for communication and perhaps regular team update meetings.

5. SET AN EXAMPLE

You’re a role model for your team, so if you arrive late to work or lose your temper in the office, don’t be surprised if other people think this behaviour is acceptable. You have to set the standards. People won’t take notice if you say one thing and do another.

6. BE CONSISTENT

Everyone is a human being and has feelings. Don’t treat people differently based on, say, their level of seniority or how much you personally like them.

7. GET TO KNOW YOUR TEAM

It’s important to know people at a personal level and build a rapport. Take an interest in the team around you. Ask how their weekend was and how they’re feeling. They’ll appreciate the personal touch.

8. ENCOURAGE QUESTIONS

People need to know that you have time for them. Remember, if they don’t feel confident to ask, they’ll probably just guess and may make mistakes.

9. BE ASSERTIVE

If you can’t make decisions, it’s hard for people in your team to respect your leadership. You need to demonstrate that you can be confident and decisive where appropriate.

10. KEEP YOUR KNOWLEDGE UP TO DATE

You need to be technically up to speed in your own specialism, as this provides you with credibility. It also allows you to support team members with any issues that arise as part of their work.

If you would like to discuss anything related to this article please do not hesitate to call Barnett & Turner on 01623 659659 or email Jonathan at jwilson@barnettandturner.co.uk

Keeping an eye on your business via the cloud

One of the great advantages of cloud accounting is that your professional adviser is there with you in real time, writes Natalie Goodall of accountancy firm Barnett & Turner

While it’s true that the key driver for using cloud accounting systems has been the government’s Making Tax Digitalprogramme, we’d usually advise all our clients to work in this way, even if they’re not VAT registered.

From our point of view, there are a number of advantages, if we notice for example, that profitability is healthy, we can work proactively to manage tax liability. On the other hand, if a client’s figures are not looking so rosy, there may be another conversation we can have, which gives us the chance to offer some specific advice or recommendations.

A key advantage is the ability to spot problems before they get out of hand. Keeping accounts in the cloud means that your professional adviser is able to log on at any time and see exactly what’s going on. While some businesses joke about ‘Big Brother’, the reality is that they soon see the advantages.

As cloud accounting became more commonplace, we started checking in on client accounts on an ad hoc basis, but we are now putting systems in place to ensure regular monitoring.

In terms of practical impact it can make, think about notification of your corporation tax bill. Would you rather have an idea of the figure eight months in advance or just a week before it became due?

Most accountants will be happy to offer some training to clients, depending on their level of confidence with software such as Xero, Sage or QuickBooks. Inevitably though, queries arise from time to time and we find that this serves as a useful communication channel. When a client calls up to ask for advice on the software, there’s always an opportunity for a five-minute chat to get up to date on their business and accounting issues.

We work closely with the leading providers, Xero and QuickBooks, and are cloud certified advisers. If you haven’t yet taken advantage of the new technology, make sure to have a chat with us to see how we can help with a stress-free demo and set up options.

If you would like to discuss anything related to this article please do not hesitate to call Barnett & Turner on 01623 659659 or email Jonathan at jwilson@barnettandturner.co.uk

Online support that helps charities tackle fraud writes Yvonne Lovett of Barnett & Turner accountants.

Cyber fraud is sadly on the increase and it’s an issue charitable trustees simply can’t afford to ignore. In fact, the government estimates that 70% of all fraud is now committed online. These scams can be complex and difficult to detect. They normally involve hacking into your system or taking your identity.

Here are 10 steps to protect yourself in cyberspace:

1. Make sure that your network is protected by a suitable firewall and malware protection is kept up-to-date (cyber criminals are constantly attempting to defeat protective defences)

2. Apply updates and patches at the earliest opportunity to limit exposure to software vulnerabilities

3. Make sure that all access to your programs is protected by strong passwords, and these are known to only essential personnel and frequently changed

4. Use a hierarchy of passwords, so – for example – only the financial controller may access the accounts system and bank account

5. Make sure that all users are trained to accept (and open) emails only from known sources;

6. Remove unnecessary software and default user accounts (these are often supplied with the software and often no attempt is made to prevent access by their removal)

7. Restrict access by mobile devices such as tablets and mobile phones to critical services such as the accounting system or online bank accounts

8. Make sure that the network configuration is secure to restrict system functionality to the minimum required for operational needs, and apply this to every device that is used to conduct business

9. Make sure that staff are trained to prevent and recognise cyber fraud activity

10.Impose “perimeter defences” to block unnecessary access to insecure websites, or only allow permitted websites to be accessed

The Charity Commission is aware of trustees’ vulnerability and there is a useful website at https://www.gov.uk/guidance/protect-your-charity-from-fraudto improve awareness of trustees and trust directors.

If you would like to discuss anything related to this article please do not hesitate to call Barnett & Turner on 01623 659659 or email Jonathan at jwilson@barnettandturner.co.uk

A Free Gift from The Taxman

In the run-up to Christmas, it’s normal to see plenty of national charity adverts tugging at our heart-strings and asking us to donate to various worthy causes. Everyone will ask the giver to gift aid their donation. Yvonne Lovett of Barnett & Turner Accountants expresses astonishment at how few of her own charity clients take advantage of the scheme.

It never ceases to amaze me that when we first meet a new charity client, how many are not making Gift Aid claims.

Why wouldn’t you? It’s free money and a no-brainer!

Charity trustees should always seek to maximise income for their charity, but we are often given excuses that it’s ‘too difficult to make a claim’, it’s ‘not worth it’ or there is ‘not much money involved’.

Here’s a reminder. For every £100 donation from an individual that a charity receives which can be gift-aided by the giver, the charity can reclaim back £25 from HMRC (while the basic rate of tax is 20%). Just think. £2,000 in gift-aided donations yields £500 tax back. Surely that’s easier than organising a coffee morning or table top-sale?

So, what’s involved with making a Gift Aid Claim?

Gift Aid Declarations: To claim Gift Aid, every donation must be supported by a declaration. There’s no need to reinvent the wheel here, as model declarations and guidance are readily available from HMRC’s website or from charity support websites. If you are a church charity, for instance, then the Parish Resources website is a great help.

Gift Aid Claims: Before your charity can claim Gift Aid, you must register with HMRC by completing and submitting the online application CHA1. If it’s a requirement that you are registered with a charity regulator (such as the Charity Commission or OSCR), you must have done so before registering with HMRC.

There are three ways to claim Gift Aid:

· Online claims through the Charities Online Service;

· Use of compliant donor management software; and

· Paper Claims (it’s still possible to claim using paper forms contrary to popular belief).

As you would expect, there are some time limits to consider and rules regarding certain types of donations where the donor might receive some benefit, but these are not too onerous and they don’t apply to most straightforward monetary gifts.

Record Keeping:Charities must maintain auditable records of declarations and of receipt of donations on which Gift Aid has been claimed. Most charity’s accounting systems should be able to provide the audit trail required

Oh, and there are more freebies to be had under the Gift Aid Small Donations Schemeor GASDS for short.

A charity can claim a Gift Aid-like top-up payment on small cash donations (notes, coins and contactless card payments) of £20 or less, a figure which will rise to £30 at the start of the 2019-2020 tax year. There is no requirement to obtain and store Gift Aid declarations. The scheme does not extend, however, to card payments, cheques and bank transfers. The top-up is calculated in the same way as Gift Aid. This means, with basic rate tax at 20%, the top-up payment is worth 25% of the value of the donation. The total value of donations eligible for the top up payment is capped at £8,000.

There we have it. Gift Aid is not too difficult, is it? So speak to your accountant about it and get claiming!

If you would like to discuss anything related to this article please do not hesitate to call Barnett & Turner on 01623 659659 or email Jonathan at jwilson@barnettandturner.co.uk